Table of Contents

ToggleUnderstanding Pool Loans

What is a pool loan, and how does it work? A pool loan is a specialized financing option designed to help individuals cover the costs associated with building a swimming pool. Unlike personal loans, which may have restrictions on how the funds are used, pool loans are tailored specifically for pool construction and related expenses.

To secure a pool loan, a good credit score is crucial. Lenders assess your creditworthiness to determine the risk of lending to you. A higher credit score often translates to more favorable loan terms, including lower interest rates.

When applying for a pool loan, you’ll need to specify the loan amount, loan term, and the type of pool project you intend to undertake. The lender will then evaluate your application and, if approved, disburse the funds directly to cover your pool expenses.

Importance of a good credit score in securing a pool loan Your credit score plays a pivotal role in the pool loan approval process. Lenders use it as a measure of your financial responsibility and ability to repay the loan. A higher credit score not only increases the likelihood of approval but also opens the door to better interest rates.

Understanding your credit score and taking steps to improve it before applying for a pool loan can significantly impact your loan terms. Check your credit report for any inaccuracies, pay off outstanding debts, and ensure timely payments on existing loans to boost your creditworthiness.

Loan amount, terms, and interest rates When considering a pool loan, it’s essential to determine the loan amount based on the estimated cost of your pool project. The loan term, or the length of time you’ll have to repay the loan, also affects your monthly payments. Shorter loan terms typically result in higher monthly payments but may save you money on overall interest.

Interest rates for pool loans can vary widely among lenders. Factors such as your credit score, loan amount, and the type of loan (fixed or variable interest rate) influence the interest rate you’re offered. Shopping around for the best rates is crucial to secure a pool loan that aligns with your financial goals.

Diving into Swimming Pool Financing Options

- Personal loans: These unsecured loans are not tied to any collateral, making them a flexible option for pool financing. They typically have higher interest rates than secured loans.

- Home equity loans: Secured by the equity in your home, these loans offer lower interest rates than personal loans. However, your home serves as collateral, and failure to repay could result in foreclosure.

- HELOCs: Similar to home equity loans, HELOCs use your home as collateral. However, they provide a revolving line of credit, allowing you to borrow as needed within a set timeframe.

Personal loans vs. home equity loans: Pros and cons Understanding the advantages and disadvantages of personal loans and home equity loans is crucial in making an informed financing decision.

- Personal loans: These loans offer flexibility, quick approval processes, and no risk to your home. However, they often come with higher interest rates and lower loan amounts compared to home equity loans.

- Home equity loans: With lower interest rates and higher loan amounts, home equity loans are an attractive option. However, the risk of losing your home in case of default should be carefully considered.

How your credit history affects your financing choices Your credit history, which includes details about your borrowing and repayment behavior, influences the financing options available to you. A positive credit history opens the door to more favorable loan terms, while a negative history may limit your choices or result in higher interest rates.

The Role of Loan Calculators in Pool Financing

Most lenders provide online loan calculators that make it easy to input different scenarios and see how they impact your monthly payment. By experimenting with various loan amounts and terms, you can find a balance that fits your budget and financial goals.

Factors affecting the monthly payment: Interest rates, loan amount, and loan term The monthly payment on a pool loan is influenced by several key factors. The interest rate is a significant contributor, with lower rates resulting in lower monthly payments. Additionally, the loan amount and loan term play crucial roles.

- Interest rate: The annual percentage rate (APR) determines the interest you’ll pay on the loan. Securing a lower interest rate can significantly reduce your monthly payments.

- Loan amount: The total amount borrowed for your pool project affects the monthly payment. Consider financing only what you need to keep payments manageable.

- Loan term: The length of time you have to repay the loan impacts your monthly obligation. While shorter terms lead to higher payments, they can save you money on overall interest.

Comparing loan options with a pool loan calculator Pool loan calculators empower you to compare different loan options and choose the one that best aligns with your financial goals. Consider experimenting with various scenarios, including different loan amounts, interest rates, and terms, to find the combination that fits your budget.

By using a pool loan calculator, you can make informed decisions about the financing option that allows you to enjoy your dream pool without breaking the bank.

Choosing the Best Pool Loan Lender

Factors to consider when selecting a pool loan lender The choice of a pool loan lender can significantly impact the overall financing experience. Consider the following factors when selecting a lender:

- Interest rates: Shop around for lenders offering competitive interest rates. A lower rate can result in significant savings over the life of the loan.

- Loan terms: Evaluate the terms offered by different lenders, including the length of the loan and any associated fees. Choose a lender whose terms align with your financial goals.

- Customer reviews: Research customer reviews and testimonials to gauge the satisfaction of previous borrowers. A reputable lender with positive feedback is more likely to provide a smooth and transparent lending process.

How interest rates for pool loans vary among lenders Interest rates for pool loans can vary based on several factors, including your credit score, the loan amount, and the lender’s policies. Different lenders may offer fixed or variable interest rates, each with its own set of advantages and considerations.

- Fixed interest rates: These rates remain constant throughout the loan term, providing stability and predictability. Fixed rates are often a preferred choice for borrowers who want to lock in a specific rate and budget accordingly.

- Variable interest rates: These rates may fluctuate based on market conditions, impacting your monthly payments. While variable rates can be lower initially, they introduce uncertainty and the potential for increased payments over time.

Tips for a smooth loan application process Completing a pool loan application can be a straightforward process if you follow a few essential tips:

- Check your credit report: Before applying, review your credit report for inaccuracies and address any issues that may impact your creditworthiness.

- Gather necessary documents: Lenders may require documentation such as proof of income, employment verification, and details about the pool project. Have these documents ready to streamline the application process.

- Compare multiple lenders: Don’t settle for the first lender you come across. Compare interest rates, terms, and customer reviews from multiple lenders to make an informed decision.

Crunching Numbers: Calculating Pool Costs

Breaking down the cost to build a pool: Installation, materials, and labor Understanding the components of pool costs is essential for accurate budgeting. The total cost to build a pool includes various factors such as:

- Installation: The process of excavating, constructing, and installing the pool structure.

- Materials: The cost of the pool shell, plumbing, filtration systems, and any additional features such as lighting or water features.

- Labor: Expenses related to the skilled professionals involved in the pool construction process.

By breaking down these costs, you can create a comprehensive budget that reflects the true financial investment required for your dream pool.

In-ground pool costs vs. above-ground pool costs The type of pool you choose significantly influences the overall cost. In-ground pools typically come with higher costs due to the complexity of excavation, construction, and additional features. Above-ground pools, while generally more affordable, may still require significant investment depending on size and features.

Consider your budget and preferences when deciding between an in-ground and above-ground pool. Factor in long-term maintenance and potential resale value to make an informed decision that aligns with your financial goals.

Additional expenses to consider in your pool project Beyond the basic installation costs, there are additional expenses to consider when planning your pool project:

- Permits and inspections: Check with your local authorities for any required permits and inspections. Factor in associated fees and ensure compliance with local regulations.

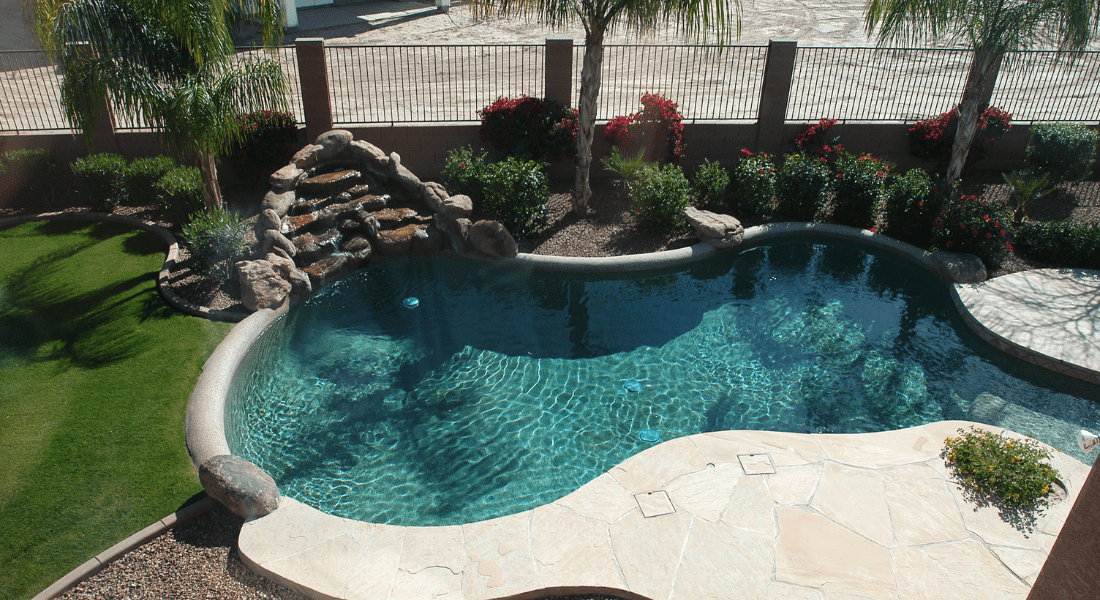

- Landscaping: Enhancing the area around your pool with landscaping adds to the overall aesthetic appeal. Consider budgeting for plants, trees, and other landscaping elements.

- Maintenance and operating costs: Budget for ongoing maintenance, water treatments, and energy costs associated with operating your pool.

Understanding and accounting for these additional expenses ensures a more accurate financial plan for your pool project.

Exploring Home Improvement Financing for Pools

Home equity loans and HELOCs: Advantages and disadvantages Home equity loans and home equity lines of credit (HELOCs) leverage the equity in your home to secure financing for your pool. Understanding the advantages and disadvantages of these options is crucial:

- Advantages: Lower interest rates compared to personal loans, higher loan amounts, and potential tax benefits.

- Disadvantages: The risk of losing your home in case of default, longer approval processes, and closing costs.

Carefully weigh these factors to determine whether a home equity loan or HELOC is the right choice for financing your dream pool.

The impact of the overall cost of your pool on loan options The total cost of your pool project influences the financing options available to you. Higher costs may require larger loan amounts, impacting your choice between personal loans and secured options like home equity loans.

Consider the overall cost of your pool, including installation, materials, and additional expenses, when exploring financing options. Choose a loan that aligns with your budget and provides the necessary funds to create the pool of your dreams.

Factors Influencing Interest Rates for Pool Loans

Before applying for a pool loan, check your credit score and take steps to improve it if necessary. A higher credit score not only increases the likelihood of loan approval but also opens the door to more favorable interest rates.

Fixed vs. variable interest rates for swimming pool loans Understanding the difference between fixed and variable interest rates is crucial when selecting a pool loan option for pool financing, offering flexibility and accessibility. A HELOC allows you to borrow against the equity in your home as needed, making it an ideal choice for projects with varying costs like pool installations. However, it’s crucial to manage a HELOC responsibly, as failure to repay could jeopardize your home. Compare the terms of a HELOC with other financing options to determine the best fit for your pool project and overall financial strategy.

Pros and cons of different funding methods

Cannonball of Wisdom: Tips for Financing a Swimming Pool Top tips for securing the best pool loan

- Know Your Budget: Determine a realistic budget for your pool project, including all associated costs. This will help you choose a financing option that aligns with your financial capabilities.

- Check Your Credit Report: Review your credit report for errors and address any discrepancies. A higher credit score increases your chances of approval and favorable loan terms.

- Explore Financing Options: Compare personal loans, home equity loans, HELOCs, and specialized pool financing to find the option that suits your needs and preferences.

- Consider Collateral: Understand the implications of using collateral, especially for home equity loans and HELOCs. Evaluate the risks and benefits before making a decision.

- Shop Around: Research multiple lenders, both traditional financial institutions and specialized pool financing providers. Compare interest rates, fees, and repayment terms to secure the best deal.

- Use a Pool Loan Calculator: Utilize online pool loan calculators to estimate monthly payments and assess different loan scenarios. This helps you make informed decisions about loan structures.

- Understand Interest Rates: Know how interest rates are determined and negotiate for the best possible rate. Even a slight reduction in interest can result in significant savings over the life of the loan.

Common mistakes to avoid in the pool financing journey

- Neglecting Hidden Costs: Factor in all potential costs associated with your pool project, including permits, landscaping, and optional features. Failing to account for these expenses can lead to financial surprises.

- Ignoring Credit Health: Your credit score plays a crucial role in loan approval and interest rates. Neglecting to review and improve your credit health before applying for a pool loan can limit your options.

- Choosing the Wrong Loan Term: Balance the length of the loan with your budget and financial goals. Selecting a longer loan term may lower monthly payments but could result in higher overall costs.

- Overlooking Collateral Risks: Understand the implications of using your home as collateral. Assess the risks and ensure you’re comfortable with the potential consequences before committing to a home equity loan or HELOC.

- Focusing Only on Interest Rates: While interest rates are crucial, consider the overall terms of the loan, including fees, repayment structure, and potential penalties. A holistic approach ensures you choose the best-fit loan for your needs.